Private credit is garnering the kind of attention only ESG, bitcoin or AI can surpass. Saving the planet, supplanting the US dollar and replacing humans with algorithms are big but, then again, if private credit takes over why do we need banks?

Private credit assets under management have grown at an annual rate of nearly 20% since 2017 to become a US$2.4trn-plus industry as of mid-2023, according to Boston Consulting Group, with two-thirds of this in North America.

Market volumes in US syndicated loans and high-yield bonds, by contrast, have more or less flatlined over the period, excluding a brief post-pandemic bounce. The US high-yield bond market is roughly the same size it was in 2015 at US$1.4trn, while the US leveraged loans market is slightly larger at US$1.7trn.

The good news for banks is that, with the stabilisation of interest rates, public credit markets are thriving again. The broadly syndicated loan market has been scoring hit after hit against direct lenders this year, IFR recently reported, with European leveraged finance bankers unleashing a barrage of unitranche refinancing worth about €5bn. In the US, 25 companies have already issued US$10.5bn of debt using broadly syndicated loans that was previously provided by direct lending in the year to March 18, data from PitchBook LCD show.

Private credit has its angle when it comes to competing against banks’ bread-and-butter business of lending or originating and distributing debt, whether it’s “volatility washing” for investors, a desire by buyout firms to diversify and fund their own deals or the benefits of certainty of execution.

But here’s the thing. Having been regulated out of and disintermediated from so many other lines of business, private credit is likely to be the hill that banks are willing to die on.

In 2023, out of a global investment banking revenue pool of around US$106bn, underwriting bond and loan offerings accounted for 34% and 24% of total fees, respectively, LSEG data show. Despite the strength of private credit and the backdrop of a lacklustre IPO and M&A environment, these debt syndication businesses saw revenues hold up well, albeit skewed towards larger issues. Given the momentum in early 2024, they remain core to investment banks’ ability to generate decent returns.

There are other benefits banks see in maintaining these businesses. The nearly US$30bn of revenues that BCG says the largest investment banks made in credit trading last year are under structural pressure. Electronic trading accounts for 45% of US investment-grade and nearly 30% of high-yield corporate bond trading volumes, according to Coalition Greenwich, with the added transparency driving down margins.

The traditional cash cow of block trading for dealer banks has been impacted by the slicing and dicing of trades, and banks have been a laggard in the growth area of trading fixed-income exchange-traded funds. In newly issued syndicated loans and high yield, by contrast, the bookrunner banks have outsized market shares and don’t see as much commoditisation from electronic trading.

Similarly, involvement in debt origination or a lending relationship is crucial for banks to win other high-margin areas of business, like treasury and payments mandates from the finance chiefs of small and medium-sized companies. Disintermediation in one business line has downstream implications for competitive pressures in other revenue streams.

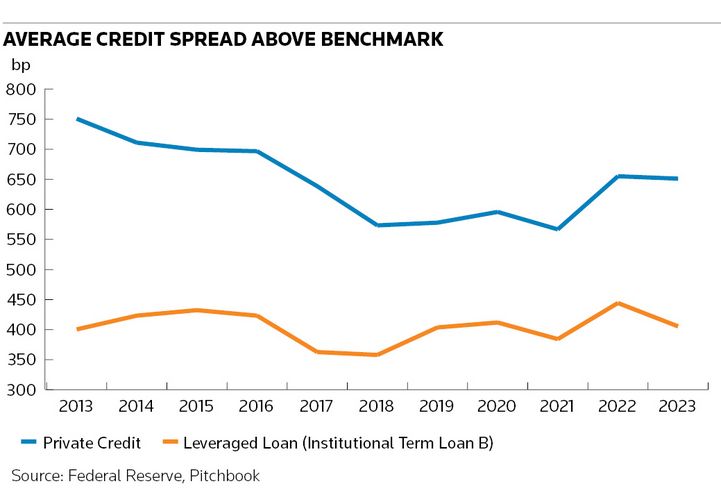

For many years, there was a tightening in the spread between the more illiquid private credit lending and bank syndicated leveraged loans. Research from the Federal Reserve shows a 350bp premium for direct lending a decade ago, which narrowed to under 200bp between 2019 and 2021 as more money flowed into private credit. More recently, this gap has started to widen again.

Private equity sponsors may be masters of the universe but they have a huge amount of dry powder that needs to be deployed and too few exits. The lower financing costs and efficiency of traditional syndicated loans and bond markets remain and will matter if sponsors want to pick things up after their 2023 slowdown.

The future may see a marrying of the two structures of bank syndicated lending and direct bilateral private credit. Banks leveraging their wider networks could act as intermediaries for corporate funding that mix balance sheet use with syndication to traditional fixed-income asset managers and private credit funds.

At a higher level, though, it would be naive to think that banks are going to price this business on a deal-by-deal basis, whether it is through old-fashioned lending and syndication or new strategies like growing their own private credit arms and partnering with existing players. The potential for banks to lose the wider revenue-making opportunities that come from their corporate client base is just too much of a risk for them to take.

Rupak Ghose is a former financials research analyst